Most people don’t realize that the generic drug they pick up at the pharmacy wasn’t chosen by their doctor alone. It was selected by a committee of pharmacists and doctors working behind the scenes for their insurance company. These lists-called preferred generic lists-are the backbone of how insurers keep drug costs down while still covering essential medications. If you’ve ever been surprised by a $5 copay for a generic pill that used to cost $150, this is why.

How Insurance Formularies Work

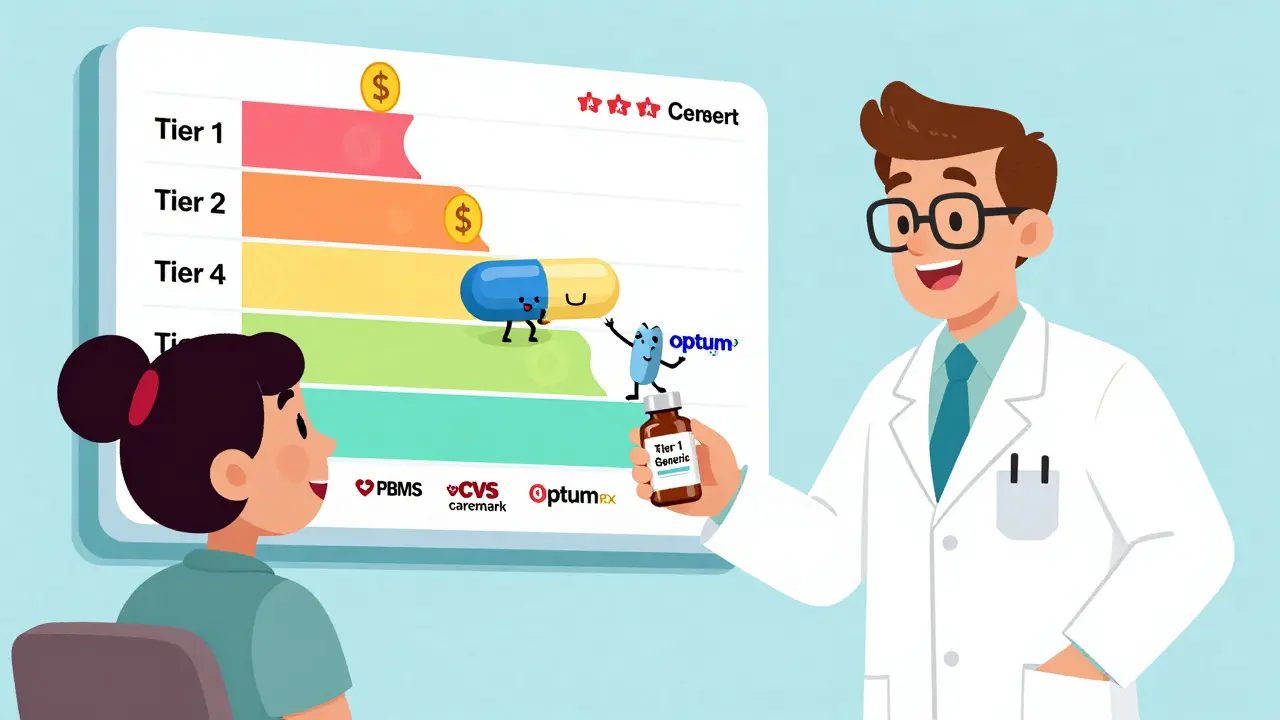

Every health insurance plan, whether it’s Medicare, Medicaid, or a private plan from Blue Cross or UnitedHealthcare, uses a formulary. Think of it as a ranked list of drugs the insurer will pay for, with the cheapest options at the top. The top tier-Tier 1-is almost always filled with preferred generic drugs. These are FDA-approved copies of brand-name medications that work the same way but cost 80-85% less. In some cases, when six or more generic versions of a drug are on the market, the price can drop by as much as 95%.

Insurers don’t just pick generics randomly. They rely on Pharmacy Benefit Managers (PBMs)-companies like CVS Health’s Caremark, OptumRx, and Evernorth-to negotiate prices and build these lists. PBMs use data on safety, effectiveness, and cost to decide which generics make the cut. A drug doesn’t need to be the cheapest to be preferred; it just needs to be proven safe, effective, and cost-efficient.

The Tier System Explained

Most formularies have four or five tiers. Here’s how they break down:

- Tier 1: Preferred generics - $5 to $15 for a 30-day supply. This is where most common medications live: lisinopril for blood pressure, atorvastatin for cholesterol, levothyroxine for thyroid issues.

- Tier 2: Preferred brand-name drugs and some higher-cost generics - $25 to $50. These are drugs that don’t have a generic yet, or where the generic isn’t as widely used.

- Tier 3: Non-preferred brand-name drugs - $50 to $100. If your doctor prescribes a brand-name drug that has a generic alternative, you’ll pay more here.

- Tier 4: Specialty drugs - $100+, sometimes a percentage of the total cost. These include biologics like Humira or Enbrel, used for autoimmune diseases.

The system is designed to nudge patients-and doctors-toward the most affordable options. In 2023, 98% of commercial insurance plans and 100% of Medicare Part D plans used this tiered structure. The goal? Save money without sacrificing health outcomes.

Why Generics? The Numbers Don’t Lie

In 2023, generics made up 90% of all prescriptions filled in the U.S. But they accounted for only 23% of total drug spending. That’s the power of preferred lists. A 2022 study found that patients paid an average of $199 per fill for a generic drug, compared to $393 for the brand-name version. That’s nearly $200 saved per prescription.

Take levothyroxine, a common thyroid medication. One Reddit user reported dropping from $187 a month for the brand to $12 for the generic. That’s over $2,000 a year saved. For chronic conditions-like high blood pressure, diabetes, or depression-those savings add up fast for both patients and insurers.

The FDA requires generics to be bioequivalent to brand-name drugs, meaning they deliver the same amount of active ingredient into the bloodstream within a tight range (80-125%). In 98.5% of cases, studies show they work just as well. So why do some people still hesitate?

The Catch: When Generics Don’t Work as Expected

Not every drug plays nice with generic substitution. For drugs with a narrow therapeutic index-like warfarin (a blood thinner)-even small changes in dosage can cause serious problems. A 2022 report from the American College of Clinical Pharmacy found that 23% of doctors avoid switching patients to generics for these drugs, fearing instability in blood levels.

Another issue: biosimilars. These are the generic versions of complex biologic drugs like Humira. While they’re cheaper, they don’t come with the same co-pay assistance programs. Brand-name biologics often have manufacturer coupons that cut monthly costs from $1,200 to $50. Biosimilars like Amjevita might list for $850, but without those coupons, patients pay the full price. One patient shared on Reddit that switching to the biosimilar actually increased their out-of-pocket costs because their insurer didn’t count the discount toward their deductible.

And then there’s step therapy. Some insurers require you to try the generic first-even if your doctor says it won’t work for you. The American Medical Association found that 42% of doctors have seen treatment delays because of this. For someone with chronic pain or rheumatoid arthritis, waiting weeks for approval can mean more suffering.

What Patients Can Do

You don’t have to accept whatever your plan says. Here’s what actually works:

- Check your formulary before enrolling. During open enrollment, look up your medications on your plan’s website. If your drug isn’t on Tier 1, consider switching plans.

- Ask your pharmacist. In 89% of states, pharmacists can swap a brand-name drug for a generic unless the doctor says “dispense as written.” Many patients don’t know this option exists.

- Appeal denials. If your insurer denies coverage for a non-preferred drug, your doctor can submit a letter of medical necessity. In 68% of cases, these appeals are approved.

- Use GoodRx or SingleCare. Sometimes the cash price at Walmart or CVS is lower than your copay. Always compare.

Patients who spend just 45 minutes a year reviewing their formulary save an average of 32% on medications. That’s not a small thing.

What’s Changing in 2025 and Beyond

The rules are shifting. Starting in 2025, Medicare Part D plans will be required to place biosimilars in the same tier as their brand-name counterparts. That could push biosimilar use from 15% to 45%-a massive change. But there’s a catch: many PBMs are now using “accumulator adjuster” programs, which don’t count biosimilar costs toward your out-of-pocket maximum. That means you could pay more upfront and still hit your cap later with a brand-name drug.

UnitedHealthcare is testing something new: “value-based formularies.” Instead of just picking the cheapest drug, they’re starting to reward medications that actually lead to better health outcomes-like fewer hospital visits or better blood sugar control. It’s early, but it could change how formularies are built forever.

The Bigger Picture

Insurers aren’t trying to be villains. They’re responding to a system where drug prices have spiraled out of control. The U.S. spends more on pharmaceuticals than any other country-and generics are the only real lever we have to pull. The $1.68 trillion saved annually by using generics isn’t just a number. It’s millions of people who can afford their prescriptions.

But the system isn’t perfect. When a patient with a rare condition gets stuck because their drug isn’t on the list, or when a biosimilar savings gets erased by a hidden policy, the cost isn’t just financial-it’s emotional. The goal should be balance: affordability without compromising care.

For now, the best strategy is simple: know your formulary. Know your options. And don’t be afraid to ask questions. Your wallet-and your health-will thank you.

Why do insurance companies prefer generic drugs over brand-name ones?

Insurance companies prefer generic drugs because they cost 80-85% less than brand-name versions and are just as safe and effective. Generic drugs help insurers control costs while still covering necessary treatments. For example, a 30-day supply of a generic blood pressure pill might cost $5, while the brand version could be $100. This keeps premiums lower and reduces out-of-pocket costs for patients.

Are generic drugs really as good as brand-name drugs?

Yes, for most medications. The FDA requires generics to deliver the same active ingredient in the same amount and at the same rate as the brand-name drug. Studies show 98.5% of generic approvals meet this standard. For common conditions like high cholesterol, diabetes, or depression, generics work just as well. The only exceptions are drugs with a narrow therapeutic index-like warfarin-where tiny differences can matter.

What is a formulary tier, and how does it affect my costs?

A formulary tier is a level in your insurance plan’s drug list that determines how much you pay. Tier 1 includes preferred generics and has the lowest copay-usually $5-$15. Tier 2 has preferred brand-name drugs and costs more. Tier 3 is for non-preferred brands, and Tier 4 is for expensive specialty drugs. The higher the tier, the more you pay. Choosing a drug on Tier 1 can save you hundreds a year.

Can my doctor override the insurance formulary?

Yes, but it requires paperwork. If your doctor believes a non-preferred drug is medically necessary-for example, if a generic caused side effects or didn’t work-they can submit a prior authorization request. Insurers approve these appeals in 68% of cases when supported by clinical documentation. You can’t just ask for a brand drug; you need a clear medical reason.

Why do some biosimilars cost more out-of-pocket than the brand name?

Because brand-name biologics often come with manufacturer co-pay cards that reduce your cost to $0 or $5. Biosimilars don’t have those programs, so even though their list price is lower, you might pay more if your insurance doesn’t cover them fully. Some insurers also use “accumulator adjuster” policies that don’t count biosimilar payments toward your out-of-pocket maximum, making them less financially beneficial than they seem.

How can I find out which drugs are on my plan’s preferred list?

Log in to your insurer’s website and look for “formulary,” “drug list,” or “preferred drugs.” Medicare plans have a Plan Finder tool with good ratings. Commercial plans vary in usability-some are easy, others are confusing. You can also call your pharmacy or ask your doctor’s office. During open enrollment, compare formularies between plans to choose the one that covers your meds best.

Do pharmacists automatically substitute generics?

In 89% of U.S. states, pharmacists can switch a brand-name prescription to a generic unless the doctor writes “dispense as written” on the prescription. Many patients don’t know this, so they end up paying more than they need to. Always ask your pharmacist: “Can I get the generic version?” It’s your right to ask.

Is it worth switching insurance plans just for better drug coverage?

If you take one or more regular medications, absolutely. A 2022 CMS analysis showed patients could save $417 per medication annually by choosing a plan with better formulary coverage. For someone on three chronic meds, that’s over $1,200 a year. Review your formulary every year during open enrollment-it’s the easiest way to lower your drug costs without changing your treatment.

So basically, insurers are the silent pharmacists? 😮 I had no idea my $5 levothyroxine was a result of some committee’s spreadsheet. Thanks for breaking this down - I’ll actually check my formulary now instead of just blaming the pharmacy for being ‘cheap’.

Man, this is big. In Nigeria, we don’t even have generics sometimes. If we did, we’d be saving so much. This system works, even if it’s weird.

Look, I get it, generics are cheaper, but come on - how many times have you heard someone say ‘the generic didn’t work for me’? I had a cousin who went from Zoloft to generic sertraline and started crying in Target for no reason. The FDA says it’s ‘bioequivalent’ but that’s just corporate-speak for ‘close enough’. And don’t even get me started on warfarin - I’ve seen people on INR rollercoasters because some PBM pushed a generic that wasn’t *really* the same. This isn’t science, it’s accounting with a stethoscope.

Insurers are parasites. They don’t care about your health - they care about their quarterly earnings. They force you into generics so they can pocket the difference while you suffer through side effects they never warned you about. And don’t even mention step therapy - that’s just bureaucratic torture disguised as cost control. The real villain? PBMs. They’re the middlemen who take 20% off the top and call it ‘negotiation’.

As an Indian guy who’s seen both systems - here, generics are everywhere and cheap as chai. In the US, it’s wild how a $5 pill can be a miracle. But I also know people who get scared switching from brand to generic because of stories from back home. Maybe we need more education, not just formularies. Also, GoodRx saved my uncle’s diabetes meds - he pays less than $10 a month now. 🙌

OMG I JUST REALIZED WHY MY BLOOD PRESSURE MEDS WENT FROM $40 TO $5 LAST MONTH 😭 I thought the pharmacy had a sale… turns out it was a FORMULARY MOVE. I’m crying happy tears. Also, I’m going to check my formulary right now. Maybe I can save on my antidepressants too… 💪❤️

From a clinical pharmacy perspective, the tiered formulary system is a rational, evidence-based approach to managing therapeutic outcomes while controlling expenditure. The key is adherence to bioequivalence thresholds and PBM-driven utilization management protocols - which, when properly implemented, reduce fragmentation and improve population health metrics. That said, accumulator adjusters and non-formulary exceptions remain systemic friction points requiring policy-level intervention.

So the insurance company is basically the real doctor now? Cool. Next they’ll be prescribing my coffee intake and telling me when to breathe. 🤡 At least when my doctor says ‘take this pill’ I can pretend he knows what he’s doing. Now I just have to pray the spreadsheet doesn’t glitch.

THIS IS WHY I HATE HEALTHCARE!! I’VE BEEN ON WARFARIN FOR 12 YEARS!! I SWITCHED TO A GENERIC AND MY INR WENT CRAZY!! I ENDED UP IN THE ER!! AND NOW MY INSURANCE WON’T COVER THE BRAND AGAIN BECAUSE I ‘WENT OFF FORMULARY’!! THEY DON’T CARE ABOUT ME!! THEY JUST WANT TO SAVE A COUPLE OF DOLLARS!! I’M SICK OF THIS!!

Generics are fine. Just don't ask questions. Just take the pill.

Y’all need to know this: if your doctor says ‘dispense as written’ - that’s your lifeline. I had a friend with epilepsy who got switched to a generic seizure med and had a seizure at work. She fought back with a letter from her neurologist and got the brand reinstated. Don’t be shy - advocate! And yes, GoodRx is your friend. I saved $200 on my insulin last month with it 🙏

Let’s be real - this isn’t about cost control, it’s about corporate control. The entire pharmaceutical ecosystem is rigged. PBMs are middlemen who get kickbacks from manufacturers to push certain generics. The FDA’s bioequivalence standards? They’re a joke. 80-125% range? That’s not precision - that’s a lottery. And then you’ve got step therapy where you’re forced to fail on three generics before you can even ask for the drug your doctor prescribed. This isn’t healthcare. It’s a prison system with pills. And the worst part? We’re all complicit because we’re too tired to fight it. So we just take the $5 pill and pretend it’s a win. It’s not. It’s surrender.

How quaint. The American system of rationing medication via spreadsheet is positively Victorian. One assumes the next innovation will be a ‘preferred generic’ for oxygen. One also assumes the PBM CEO is sipping champagne on a yacht somewhere, laughing at the notion that ‘bioequivalence’ is a meaningful term. Honestly, I’d rather pay £200 for a brand-name pill than participate in this farce. At least then I’d know I’m paying for something that isn’t just a legal loophole with a pill-shaped face.

Formulary tiers are an example of utilization management in action. PBMs leverage rebate structures and therapeutic interchange protocols to optimize spend. The tiered structure aligns with clinical guidelines and cost-effectiveness thresholds. However, accumulator adjusters create moral hazard and distort patient cost-sharing incentives.

Okay, but let’s talk about the real elephant in the room - why do brand-name drug companies still get away with charging $1,200/month when they’ve had 20 years to recoup R&D? And why do PBMs get to keep the rebates instead of passing them to patients? The ‘generic = savings’ narrative is true, but it’s also a distraction. The real problem is the entire drug pricing model. We’re fixing the wrong part of the machine.